geothermal tax credit new york

Geothermal geothermal heating geothermal cooling natural heat source oil alternatives geothermal tax credit federal tax credit for. What tax credits are available for geothermal.

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Located in New Rochelle serving the greater Tri-state Area.

. The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for. 17 Columbia Circle Albany NY 12203-6399 See Our Other Offices. 20222030New York United States.

Geothermal is the most efficient heating and cooling system on earth. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits. We are your new solution to heating cooling needs since 2008.

Learn about the ways you can save money with the Federal Geothermal Tax Credit and the New York State Geothermal Incentive through NYSERDA. Rebates are capped at 70. Check Rebates Incentives.

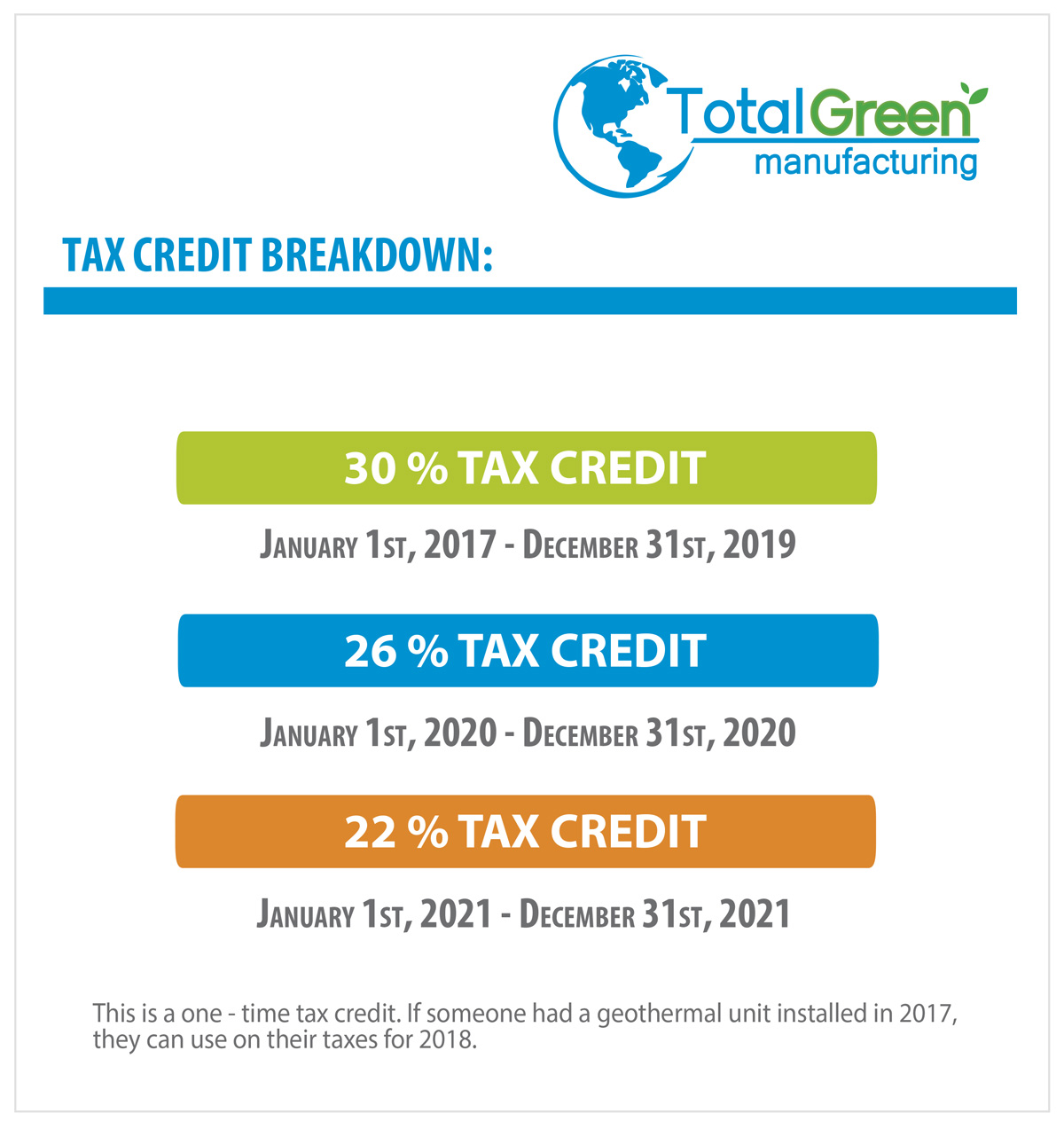

The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income tax liability is less than 5000When coupled with the 26 federal tax credit and rebates provided by New Yorks utilities this new income tax credit will help make geothermal systems even more. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. These tax credits are retroactive to Jan 1 2017.

This bill allows for a 25 state income tax credit up to a maximum of 5000 for a new geothermal HVAC system. Todd Kaminsky D-NY chair of the New York State Senates Environmental Conservation Committee in a written statement. New Yorkers have more reason than ever to move towards air and ground source heat pumps.

We also encourage you to consult an accountant or tax advisor if you have any questions. New York offers state solar tax credits capped at 5000. A Federal Tax Credit of 30 also is now available.

Additionally homeowners are eligible for New York States Clean Heat Program which is administered by the homeowners utility. The Renewable Heat Now Campaign is organizing to win funding and policies that will get fossil fuels out of our buildings affordably and equitably The legislative package includes a geothermal tax credit S3864A7493 and sales tax exemption S642aA8147 as well as the All-Electric Building Act S6843a A8431 that would sunset fossil fuels in new. This alternative energy solutions transfers heat energy between the ground and your home.

You may qualify for the refundable college tuition credit. 26 federal tax credit has been extended. The incentive will be lowered to 22 for systems that are installed in 2023 so.

48000 BTU in a 2500 sq ft home get an 8383 rebate for a new Dandelion Geothermal system. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. June 12 2015.

Federal Geothermal Tax Credits. New York State offers several New York City income tax credits that can reduce the amount of New York City income tax you owe. It now is before Governor Andrew Cuomo for signature and adoption or veto.

Since geothermal systems are the most efficient heating and cooling units available the United States federal government has enacted a 26 federal geothermal tax credit with no upper limit. Central Northern Upstate New York State homebuilders commercial building owners may qualify for a geothermal tax credit via the Energy Improvement Extension Act of 2008. Calculate Your Savings In 2 Minutes.

The most commonly used forms and instructions are listed here. Serving New York and Connecticut. The Mass Save rebate program offers 15000 per home for oil propane and electric resistance homeowners switching to geothermal.

An act to amend the tax law in relation to establishing a credit for geothermal energy systems PURPOSE OR GENERAL IDEA OF THE BILL. 2708 Clinton Street West Seneca NY 14224 716-684-8848 Sales. Get Qualified In 2 Minutes Or Less.

You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. Credits have been extended to December 31 2021. If youre a New York State resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

US Tax Credits Through 2023. Infonyserdanygov 518-862-1090 866-NYSERDA Toll free Fax. Homeowners are eligible for a 25 New York State tax credit on geothermal installation expenses up to 5000.

In 2019 the tax credit was renewed at 30 of the total system cost which dropped to 26 in 2020. In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential. S3864 ACTIVE - Sponsor Memo.

Combined with the current 26 federal tax credit for geothermal systems state incentives now give residents in most parts of New York an average of 50 reduction in what the usual costs of geothermal would be. Using a geothermal heat pump is a climate-friendly energy-efficient option available to heat and cool your home and this tax credit will make transitioning to them more affordable for New York homeowners said state Sen. Ad Take Advantage Of Solar Tax Credit For 2022.

New York State offers a 25 tax credit on geothermal installation expenses up to 5000. The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income tax liability is less than 5000When coupled with the 26 federal tax credit and rebates provided by New Yorks utilities this new income tax credit will help make geothermal systems even more. Did you your spouse or your dependent attend college.

This number will carry through until the end of 2022 and drops to 22 in 2023. The global geothermal heat pumps market size was valued at USD 105172 million in 2021 and is expected to reach a valuation of USD 19416 million by 2030. The Ne w York State Assembly and Senate have passed the Geothermal Tax Credit bill A2177A A2177A-2015.

This bill establishes a tax credit for the purchase and installation of geothermal energy systems. The measure will make homeowners eligible for a 25 tax credit of up to 5000 for the installation of geothermal systems. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US.

PUBLISHED 536 AM EDT Apr. New York homeowners who purchase and install geothermal heat pump systems could be in line for a tax credit under a provision given final approval in the state budget this month. Huge Utility Rebates.

New York State Energy Tax Credits. KENNEDY TITLE OF BILL. Are you a full-year New York State resident.

The tentative 2022-23 state budget would establish a tax credit for the purchase and installation of residential geothermal energy systems which use the solar thermal energy stored in.

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Geothermal Investment Tax Credit Extended Through 2023

26 Federal Tax Credit On Geothermal Heat Pumps Symbiont Service

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Savings Calculator How Much Waterless Dx Geothermal Can Save You

Incentives Aces Energy Wny Geothermal And Solar Installer

Solar Incentives Aces Energy Wny Geothermal And Solar Installer

300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

How Tax Credits Work Howstuffworks

Incentives Aces Energy Wny Geothermal And Solar Installer

Tax Credits For Geothermal Lake Country Geothermal

How The 2022 Federal Geothermal Tax Credit Works

Taking On An Audacious National Retrofit Mission Would Enable Canada To Upgrade Every Build Heat Pump Installation Renewable Energy Resources Energy Retrofit

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

The Federal Geothermal Tax Credit Your Questions Answered

Federal Tax Credit Only For A Limited Time Waterfurnace

Federal Tax Credits Geothermal Heat Pumps Energy Star

Updated Irs Releases 2022 Section 45 Production Tax Credit Amounts Mayer Brown Tax Equity Times Jdsupra